seattle payroll tax ordinance

Beginning in 2022 the tax must be paid on a quarterly basis. Seattle has finalized its payroll expense tax rules effective January 1 2021.

Council Discusses Details Of Proposed Payroll Tax

Adding a new Chapter 538 to the Seattle Municipal Code.

. On July 6 2020 the Seattle City Council passed City Ordinance Number 126108 imposing a payroll expense tax on persons engaging in business in Seattle. The payroll expense tax is levied upon businesses not individual employees. On July 6 2020 the Seattle City Council voted 7-2 to pass Council Bill 119810 which imposes a Seattle payroll expense excise tax on large employers.

Seattle Payroll Tax. The ordinance takes effect at the start of 2021 and sunsets at the end of 2040. Body WHEREAS on July 6 2020 the City Council passed Ordinance 126108 imposing a progressive tax on businesses with payrolls of 7 million and higher annually Payroll Expense.

The final rules generally adhere to the draft rules except that they remove a provision stating that an employees home is not a business location of the taxpayer Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. While the ordinance has not yet been signed by the mayor as of publication the tax. 322k members in the Seattle community.

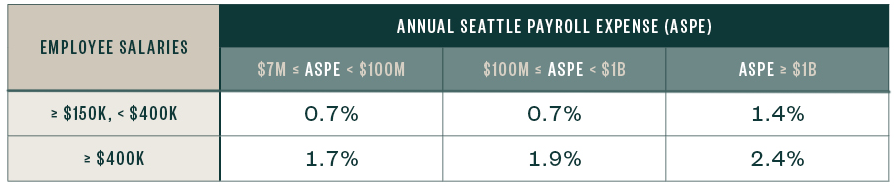

WHEREAS the new payroll tax is anticipated to generate about 2143 million in proceeds in 2021 as shown in the spending plan included as Attachment 1 to this ordinance. The payroll expense tax. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or.

AN ORDINANCE related to creating a fund for Payroll Expense Tax revenues. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. The rules clarify several areas of uncertainty in how the ordinance.

We previously issued a blast on this ordinance with details on how this tax applies to businesses. And providing additional guidelines for expending proceeds. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle.

And WHEREAS on July 6 2020 the Council adopted the ordinance introduced as CB 119811 establishing the categories of spending authorized for use of the proceeds generated from the. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code. The tax could be replaced by future county or state taxes and will sunset in 2040 The ordinance expresses the Councils intent to revisit the payroll tax if replacement revenue from.

To administer and evaluate the effectiveness of the payroll tax authorized by the ordinance introduced as Council Bill 119810 to administer the investments described in subsections 2B2 through 2B5 of this ordinance and to evaluate. While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective. The ordinance includes a provision allowing apportionment of payroll expense for payroll related to work done and.

And the employee resides in Seattle. 24 tax on annual individual employee compensation at or above 400000. Effective January of 2021 the City of Seattle will impose a payroll expense tax on businesses operating in Seattle.

Imposing a payroll expense tax on persons engaging in business in Seattle. LEG Tax on Corporate Payroll Spending Plan ORD D10b. A business must have at least 7 million in Seattle payroll in the prior calendar year to be subject to the tax.

The city of Seattle has recently enacted a new Payroll Expense Tax. AN ORDINANCE relating to taxation. The payroll expense tax for 2021 is due January 31 2022.

The intent is to use the proceeds from the payroll tax authorized by the ordinance introduced as Council Bill 119810 as follows. Update and Frequently Asked Questions. EDT - Seattles tax which targets businesses with highly paid employees is an excise tax not an unconstitutional income tax as argued by the Seattle Metropolitan Chamber of Commerce a Washington state courtSeattles JumpStart Seattle tax for companies with employees who have paid more than 150000 is the.

For employees who perform work partly within and partly outside Seattle the compensation paid in Seattle to those employees shall be for each individual employee the portion of the employees annual compensation which the total number of the employees hours worked within Seattle bears to the total number of the employees hours worked within and. An overview of the ordinance follows. You may have already heard about this new tax.

Adding a new Section 538055 to the Seattle Municipal Code. The move which went into effect Jan. The City of Seattle has finalized their rule on the new payroll expense tax which became effective January 1 2021.

JumpStart Seattle City Ordinance 126108 on wages being paid to Seattle employees. The draft rules address. The payroll expense tax is levied on the employers Seattle payroll expense which is defined as compensation paid in Seattle to employees.

The payroll expense tax is set to expire Dec. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more. Law360 Jun 5 2021 1045 am.

Seattle Payroll Expense Tax New Rule and Guidance Issued. 31 204020 Commentary Similar to the previous tax initiatives sought by the Seattle City Council such as the income tax and the payroll headcount tax the JumpStart tax has also drawn strong criticism from the Seattle business community. While publicly touted as a tax on large businesses the payroll expense tax will.

News current events in around Seattle Washington USA. Beginning January 1 2022 these amounts will be adjusted annually to reflect inflation. Compensation includes amounts for the following whether based on profit or otherwise earned for services rendered or work performed whether paid directly or through an agent and whether in cash or property or the right to.

3 CITY OF SEATTLE 4 ORDINANCE _____ 5 COUNCIL BILL _____ 6 title 7 AN ORDINANCE establishing a spending plan for the proceeds generated from the payroll 8 expense tax authorized by the ordinance introduced as Council Bill _____ to fund 9 immediate cash assistance for low-income.

Seattle Payroll Expense Excise Tax Details

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Council Discusses Details Of Proposed Payroll Tax

Council Connection Councilmember Mosqueda Moves Forward With Transparency And Accountability Measures For Jumpstart Seattle

Seattle Payroll Expense Excise Tax Details

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

Seattle Payroll Expense Tax New Rule And Guidance Issued Berntson Porter Company Pllc

First Results For Seattle S Tax On Its Largest Employers Are In With Stronger Than Expected Revenue For Housing Small Business And The Environment Chs Capitol Hill Seattle

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

How Commuter Benefits Will Work In Seattle Commuter Benefit Solutions

Council Discusses Details Of Proposed Payroll Tax

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Seattle S Payroll Tax Complicates Efforts To Implement One Statewide

Council Connection Councilmember Mosqueda Moves Forward With Transparency And Accountability Measures For Jumpstart Seattle